Adventures in Bitcoin

Last week, I spent some time with my pal and her sister in Washington DC. We had a great time visiting different sites, and at the end of the day, I looked at my phone and checked my Coinbase exchange positions (as one does). I let out a sigh.

“Well, I totally missed Bitcoin’s price recovery,” I said.

I am new to crypto. I started dabbling last fall (BTC traded at approximately $67K back then) and have fallen deeper into the crypto universe ever since. Still, four months is nothing when you consider that crypto started in 2008. Yet, a lot can change in a few months, about $20K in Bitcoin value to be more specific.

At my lament, my friend asked, ‘What is Bitcoin?’ or something like that. Of course, I knew she had heard of Bitcoin. What she meant was more nuanced.

I have been immersed in crypto long enough now to know that when non-crypto people (often referred to as ‘normies’) ask you about crypto, it is a great opportunity to evangelize about the benefits of cryptocurrency to the global monetary system. So, I tried to explain Bitcoin and said a bunch of words like ‘ledger,’ ‘decentralized finance,’ ‘internet protocol,’ ‘blockchain technology,’ and ‘payment rails.’

My friend’s response went something like, “you just said a bunch of words and I don’t know what they mean.”

Since I failed to provide a clear answer to the question, I will now try to explain what the question, ‘What is Bitcoin?’, really asks. Here goes.

First off, I believe that what most people are asking is not ‘What is Bitcoin?’ but rather “Why Bitcoin?’

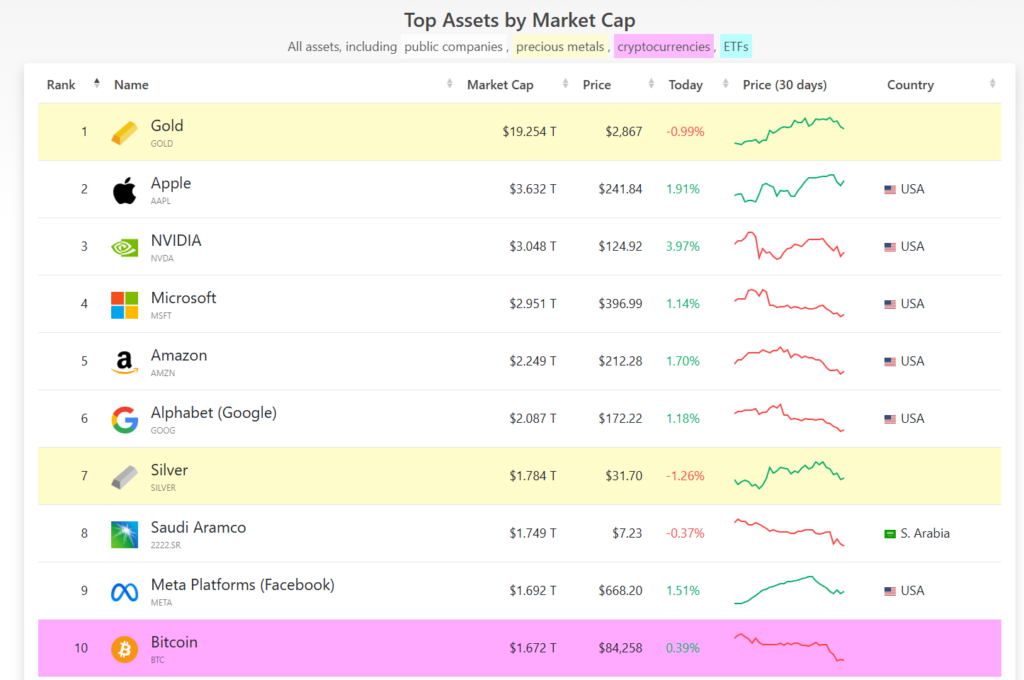

As of this writing, Bitcoin commands a $1.673T market capitalization. That means people have chosen to turn their spending power (i.e. money) into Bitcoin to the tune of over one trillion dollars and counting. I know, it’s a huge and meaningless number. Compare it to other things people have turned their money into. Just look at this chart. Bitcoin is in the top ten. Wow.

The next most logical question then is, ‘How is it that Bitcoin’s market cap is nearly that of Meta’s? At least I know what Meta is used for!’

Fair.

Bitcoin, like Meta, introduced an invention to the world, one in which is transferring value between strangers on the internet is possible without the need of a bank or any other third party (i.e. Venmo, Zelle, etc.). You probably don’t think about it, but anytime you move money digitally some other entity is involved. They must be. It could be Venmo (with the help of Visa), it could be Apple Pay (with the help of Visa), it could be Zelle (with the help of your bank). Just think about it, have you ever moved money digitally directly to another human the way you could hand me $20? The answer is no.

Until Bitcoin.

In the early days it was the nerdiest of computer people playing around with Bitcoin. They mined it (i.e. produced it) and sent it; they bought it and sold it. Eventually drug dealers and other bad actors found it useful since they find it a business liability to send money electronically and prefer to deal in cash. As more groups of people found Bitcoin useful, the price of one bitcoin went up. As the price increased and adoption grew, Bitcoin began to attract more attention, creating a virtuous cycle of growth, attention, and further adoption and more growth, more attention, more adoption. Because there are only 21 million Bitcoins ever to exist, rules of supply and demand apply and as demand increases, prices go up. The same is true in the opposite direction. At this point, Bitcoin is just an asset, like the rest of the assets in the top ten list.

So, can you do anything with Bitcoin? Sure, you can buy things with it, but it’s a bit like buying things with gold. It’s not the most efficient use of your Bitcoin, nor is it convenient since you must convert it into fiat currency (i.e., cash).

So again, who cares about Bitcoin if I can’t do anything with it?

To that, I say, what can you do with gold? I guess you can make jewelry. What else? It’s just a store of value. The same goes for Bitcoin.

There’s more to it. There are now hundreds of cryptocurrencies, some project-related and some just memes. Stablecoins are likely the most exciting and applicable use case for people who don’t like surprises when they view their balance. There’s Web 3.0, staking, yield farming, and all sorts of other things that I’m vaguely familiar with and others I don’t know about at all. As for me, I’m still dabbling. Something about the revolutionary nature of it makes me want to participate and learn and nerd the heck out. So I’ll be keeping an eye on the exchange, monitoring the candlestick chart and price movements and X threads closely, ready to buy this next dip.

Leave a Reply